Executive Talent Magazine

How will the Fourth Industrial Revolution impact the skills that executives need in order to thrive in such a rapidly changing sector?

The first Industrial Revolution, in the 18th century, created machines to replace manual labor, and gave us the steam engine and water power. In the early 20th century, the second Industrial Revolution gave us electricity, which birthed the assembly line and mass production. Between the 1950s-70s, electronics, computers and digital technology gave birth to automation in manufacturing – ushering in the third Industrial Revolution.

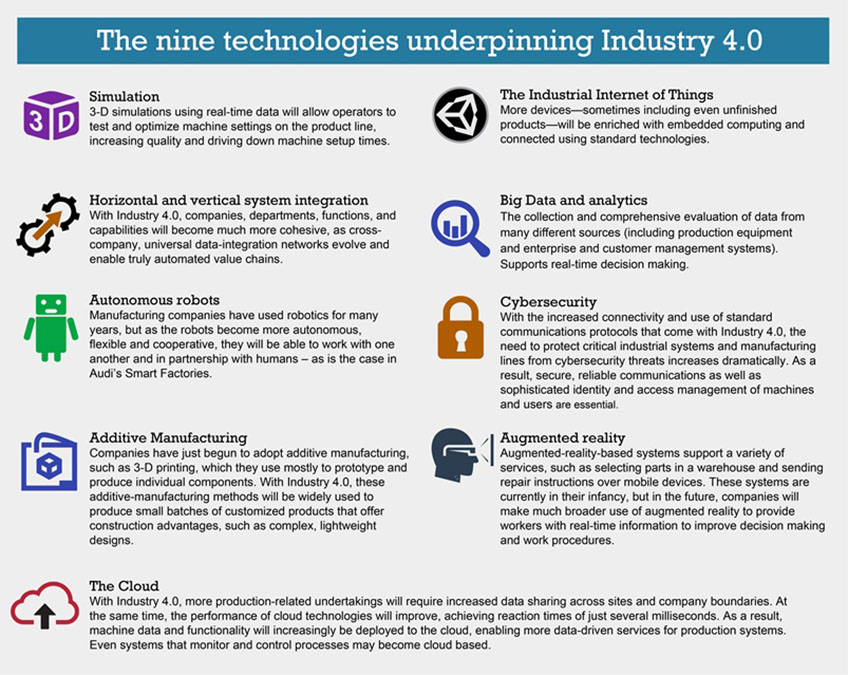

And now we face the fourth Industrial Revolution – or, as the German government called it for the first time in 2011, Industry 4.0. There are nine core tenets of Industry 4.0, some of which have existed for some time in a partially siloed environment. But Industrial business leaders believe that they now have the technology to combine these tenets to have a revolutionary effect.

PwC’s recent Industry 4.0 survey gathered information from more than 2,000 companies across 26 countries and demonstrates the excitement in the sector about the confluence of these technologies. Globally, over one-third of businesses expect their revenue gains to exceed 20% over the next five years, while 43% expect to lower costs by more than 20% over the next five years and 56% expect to increase efficiency by more than 20% over the next five years.

The level of optimism shows that Industry 4.0 is not a gimmick or a PR stunt – it is enabling Industrial businesses to expand their portfolio of products and services, drive efficiency and innovation, cut costs and lead to greater opportunities for globalization.

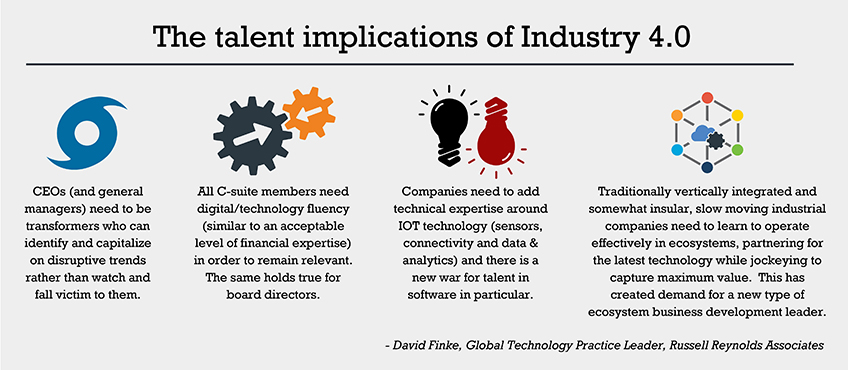

As technology grows exponentially, business leaders will have to make complex calculations based on a number of factors quickly, as Bernard Perry (UK), Managing Partner at TRANSEARCH, explains. “What’s interesting about the leaders of tomorrow is they will need to see the big picture and the very fine detail simultaneously,” he says. “You don’t need to be a programmer or a digital expert, but you do need to recognize and extract the relevant and valuable insights from the quantity, granularity and speed of available information.”

Opportunities and evolving business models

The new landscape for innovative approaches and entirely new service lines may be exciting Industrial business leaders, but success hinges on how quickly businesses can identify opportunities and execute on them. This is particularly true of the Industrial giants, many of whom have been in existence for decades, if not a century, and have hundreds of thousands of employees. As the saying goes: the bigger the ship, the longer it takes to turn around. So can these Industrial cruise liners mobilize or are they at risk of disruption from more nimble businesses?

Robert Quinn (Canada), Partner at Odgers Berndtson, says: “We’re seeing an evolution of business models, especially in capital-intensive businesses. Instead of just manufacturing a product, businesses are now manufacturing and servicing the product, using advanced data and analytics. And then in some instances they are manufacturing, servicing and financing the product. Their clients no longer want to pay for a billion dollar power plant – they want to lease it by the hour. In turn, the Industrial companies are moving further upstream.”

For example, in 2009 the General Electric CEO Jeffrey Immelt paid a visit to some GE scientists who were working on onboard sensors for jet engines. During the conversation, he realized that the data could someday be as valuable as the jet engine itself, if not more so. He set in motion a new strategy to target what is now called “the industrial internet” – which will collect and analyze data on how GE’s hardware performs, enabling GE to continuously improve the products they lease to their clients. But this strategy sailed GE into occupied waters – pitting the 124-yearold company against the likes of Amazon and IBM. In spite of the competition, the strategy could yield a significant pay-off, with GE executives recently predicting that the market for the industrial internet will reach $225 billion by 2020.

Gert Herold (Austria), Global Industrial Practice Leader for Stanton Chase, explains that this transition hasn’t been comfortable for everyone. “The entrepreneurial spirit died down and people took fewer risks after 2009 [financial crisis],” he says. “Decisions have been postponed. Even in recruitment, Industrial companies have been playing on the safe side and only taking people from the competition. But in reality you’re stirring from the same soup and it has to be changed. If you have a structural problem, you have to look to bring in expertise from other areas.”

Blurred lines

But as Jordan L. Brugg, Spencer Stuart’s North American Industrial Practice Lead, explains, the move upstream has led to greater competition from other sectors and competition for talent can cut both ways. “The lines between the Industrial and Technology sectors today are really blending,” he says. “Industrial companies have to compete for talent against tech companies such as Google, Apple and others. There is absolutely a war for talent and the perception is that many of the older Industrial companies have been slower to change.”

For Industrial companies that find themselves losing talent to technology companies, Brugg recommends that they think about part of their value proposition in terms of legacy and heritage. “They have a track record of adapting to change over a much longer period of time – many going back one or two Industrial Revolutions. They have the experience and history to show that they can make technological advances and adapt to changes that fundamentally alter how we live and work.”

What does this mean for the profession?

The rate of change and innovation within the sector raises questions over how executive search consultants can remain relevant. When at least a part of your value proposition hinges on your industry experience and knowledge, how can you ensure that you keep pace with your clients’ needs and understand the leadership challenges they are facing? This is particularly pertinent as, according to AESC’s Executive Talent 2020 report, the Industrial sector accounted for 28.4% of searches started across the profession in 2015.

Stanton Chase’s Herold explains: “We have to understand the technologies behind these innovations and the changes that has on leadership style and the labor market. We have to make sure that we stay educated and understand what the early adopters are doing. We now have clients asking us for entirely new roles. It’s similar to the internet and e-commerce – many clients didn’t know what they were looking for and relied on our expertise.”

Spencer Stuart’s Brugg explains that the speed of change and innovation also makes it challenging for clients to build meaningful succession plans. “The common challenge is that with the rate of change, it’s hard to predict what the business is going to need long-term. You need to be forward thinking, but long-range planning can now fall into shorter cycle times since the speed of current technology breakthroughs and its impact on how business operates is unprecedented.“

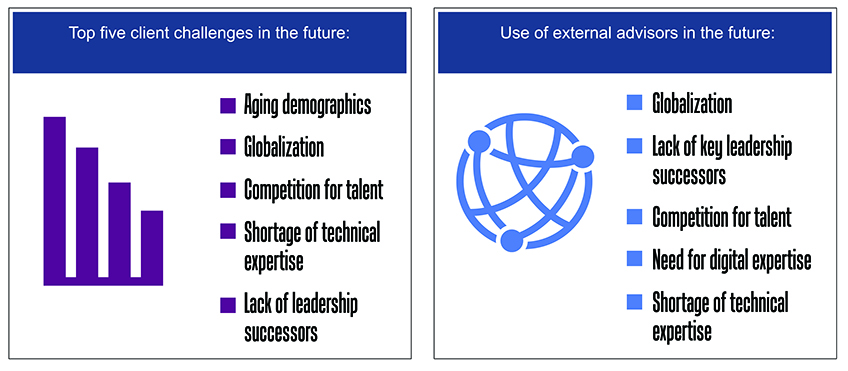

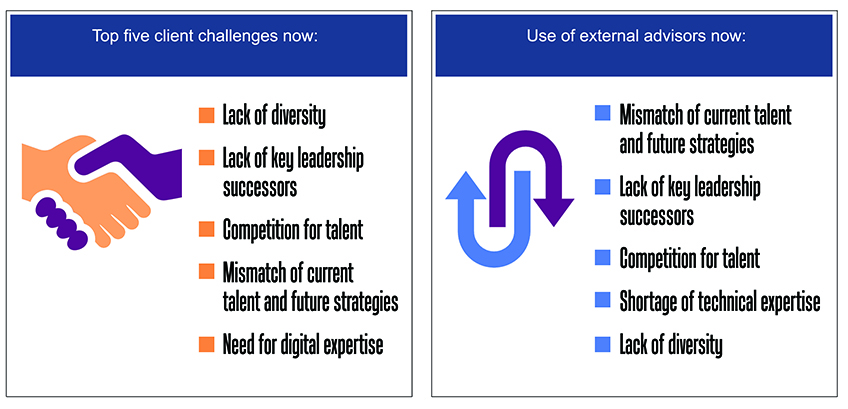

In AESC’s Executive Talent 2020 report, we asked clients about their top three areas in which they would consider working with an external advisor today and in the next five years. ‘Lack of key leadership successors’, ‘mismatch of current and future strategies’ and ‘need for digital expertise’ all ranked in the top five challenges being faced today. They also ranked highly in the areas that clients intended to work with external advisors today.

When looking at how this changes in five years’ time, we can see that the top challenges shift and the areas where clients expect to work with external advisors tend to become less of a concern. This shows that there is optimism about the positive impact that external advisors can have in the near future to help clients deal with the rapid changes that are taking place.

It is notable that ‘globalization’ becomes the second biggest challenge and the biggest area that clients expect to work with external advisors in the future. In a recent whitepaper on Industry 4.0, Deloitte explained that “technology will become the universal language of business”. Ultimately, many of the technological developments underpinning Industry 4.0 will drive unprecedented opportunities for globalization, but clients will have to move quickly to ensure they have the infrastructure, strategy and talent to capitalize on this opportunity.

By experimenting with combined human and robotic workforces – as companies like Audi are doing in their Smart Factories – they have the potential to shape the future of many workplaces around the world. But responding to these opportunities requires agility and technical acumen – both in terms of the Industrial leaders and the executive search consultants who place them.