Blog

Below is the introduction to AESC’s report Executive Talent 2020. Click here to read the whole report.

This special edition of Executive Talent looks at the past, present and future of the executive search and leadership consulting profession. In this section we compare data from AESC’s 2010 report Executive Search in Transition to today’s data, and use this to predict what the future holds for the profession.

Executive Search

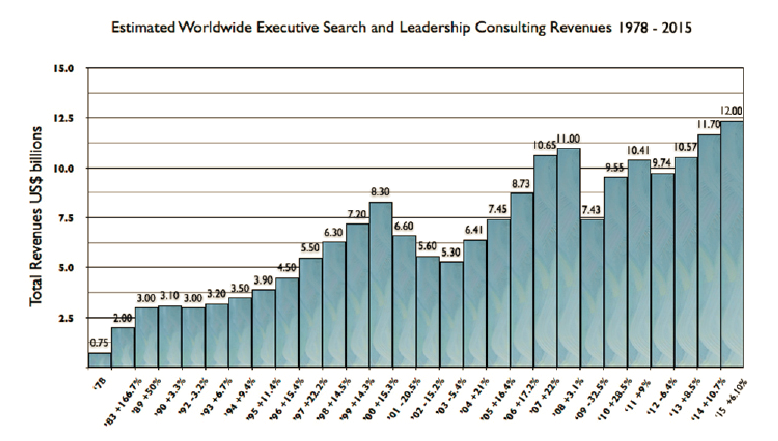

This report shows that executive search is a robust business that provides a valued advisory service to clients. Based on figures for 2015, executive search represents on average 92% of the total revenue for our members. Executive talent acquisition is a sensitive and confidential process focused on the top leadership roles in an organization. Clients clearly value being advised by experts who can be trusted based on their industry and functional expertise, and their ability to engage with and entice the best candidates locally and globally as needed. In the 2010 report, two-thirds (67%) of AESC members expected demand in executive search to increase over the next five years. Looking at AESC’s State of the Industry data, we estimate that global revenues for the profession have increased by 27.9% during this time from $9.55 billion to $12 billion. But what has led to such strong growth?

In 2010 the profession was concerned about disintermediation from in-house talent acquisition teams and contingent recruiters. Over three-quarters (76%) of AESC members said that competition had increased, with 58% saying they were losing searches to contingency firms and 42% saying they were losing searches to in-house talent acquisition teams. Three-quarters (73%) of the clients we surveyed this year expect their use of executive search to either increase or stay the same over the next five years. As we reveal in the client section of this report (section three, page 35), executive search is favored for confidential searches, board and C-suite searches, cross border searches, difficult to complete searches and searches where the salary level is above $200k USD. The data suggests, in fact, that contingent recruiters are expected to see a decline in their services as in-house talent acquisition continues to grow.

How can executive search firms become closer to their clients over the next five years? We asked clients which metrics meant the most to them. In 2010 the majority of the metrics that were mentioned related to the search process (time to long/short list, quality of long/short list, quality of marketplace information etc.), but five years later the most important metrics are more sophisticated and results-oriented – the two most important metrics today are business performance of the successful candidate over time (70%) and tenure of the successful candidate (41%). One of the big takeaways from the candidate section of this report (section four, page 40) is that candidates placed by AESC members stay in their roles longer.

Finally, in the last five years diversity has become a much more prominent issue. Our 2010 report discussed the issue of diversity briefly, but today we see that it ranks among clients’ top business concerns. It is clearly a complicated issue, and one that varies around the world, but it is in the foreground of many executive talent conversations. AESC members are committed to diversity and the value that diverse leadership teams provide.

Leadership Consulting

In 2010 we acknowledged leadership consulting as an opportunity for executive search firms, with 69% of respondents saying that their clients were asking for services beyond executive search. That demand has begun to come to fruition in the last five years. Leadership consulting now contributes 5% of total global revenue for the profession, excluding revenue from Korn Ferry. Deals like Korn Ferry’s for Hay Group, PDI Ninth House and Global Novations; and Heidrick & Struggles’ for Senn Delaney and Co Company are game changers. By acquiring established consulting firms, our profession is demonstrating its commitment to more rapid growth into a broader range of leadership advisory services. Many firms around the world are adding new talent, tools and methodologies to build leadership advisory capability to respond to increasing client need. And there are firms, large and small, that have had leadership advisory services as a core part of their service offering for many years.

We asked clients if they would partner with their current executive search firms for a broader range of leadership advisory services beyond executive search (page 33). In eight of the nine areas we listed, at least 66% of clients said they would be open to the idea. And in the future the levels of interest either increased or stayed the same in all nine areas, with interest for succession planning and internal talent assessment ranking particularly high – showing the value that executive talent advisors can provide by broadening their service offering.

Our 2010 report predicted that there would be an increase in the number of leadership consulting specialists in the profession. This is certainly something that we have seen over the last five years, with executive search firms building specialized capabilities through acquisitions or by bringing in specialists and developing their own proprietary techniques. In this report, we reveal that 25% of AESC member firm leaders intend to hire more leadership consulting specialist this year (page 29).

Executive Talent 2020

Over the last five years the executive search and leadership consulting profession has continuously proved its value to clients, as demonstrated through the increase in global revenues. In 2010, 79% of AESC members expected their firms to become more specialized, a trend that has been realized. Indeed, in this report clients indicate that the two most important reasons for selecting an executive search firm are the consultant’s and the firm’s industry/functional/geographic expertise.

This desire from clients for specialists and expertise continues to push executive search and leadership consulting firms to add increased strategic value. As a result of the strength of these relationships, clients see broader value in working with an external advisor who specializes in executive talent, thus driving the demand for leadership consulting services. As we mention above, if this demand is to be maintained it must be serviced by experts, presenting an opportunity for the profession to expand, broaden and diversify.

This report shows that the executive search profession is stronger than ever, with growth opportunities emerging through the need for new skills, the emergence of new executive roles, new markets for executive talent, aging demographics and the changing needs of clients who are seeing significant changes in their business strategies impacted by megatrends such as globalization and digital transformation. While we see challenges for our profession including increased competition from firms who do not have the high standards required by AESC, we believe the next five years will show continued growth and expansion for the profession.

This is the introduction to AESC’s report Executive Talent 2020. Click here to read the whole report.